2019 PIMCO Qualified Dividend Rates

PIMCO SHAREHOLDERS

PIMCO Funds

This document contains tax information on PIMCO open-end mutual funds, closed-end funds and interval

funds (“PIMCO funds”). Certain PIMCO funds may have qualified dividend, qualified short-term and/or

qualified foreign rates. The qualified amount, if applicable, will be in box 1b of your Form 1099-DIV. The

rates outlined below were used to calculate the qualified amount. See the Form 1040/1040A instructions

or consult a tax professional for specific advice on how to determine this amount.

Please call us at the applicable number provided below if you have questions or need assistance. You can

also visit the Tax Center page of our website, pimco.com/tax. As PIMCO does not provide legal or tax

advice, please consult a tax professional and/or legal counsel with any specific tax questions and concerns.

Telephone Number Transfer Agent

PIMCO Open-End Mutual Funds: 888.87.PIMCO (888.877.4626) Boston Financial Data Services, Inc. (BFDS)

PIMCO Closed-End Funds: 844.33.PIMCO (844.337.4626)

American Stock Transfer & Trust Company,

LLC (AST)

PIMCO Interval Funds: 844.312.2113 DST Systems, Inc.

PIMCO Open-End Mutual Funds

PIMCO Closed-End Funds

PIMCO Interval Funds

2 2019 QUALIFIED DIVIDEND INFORMATION | PIMCO SHAREHOLDERS

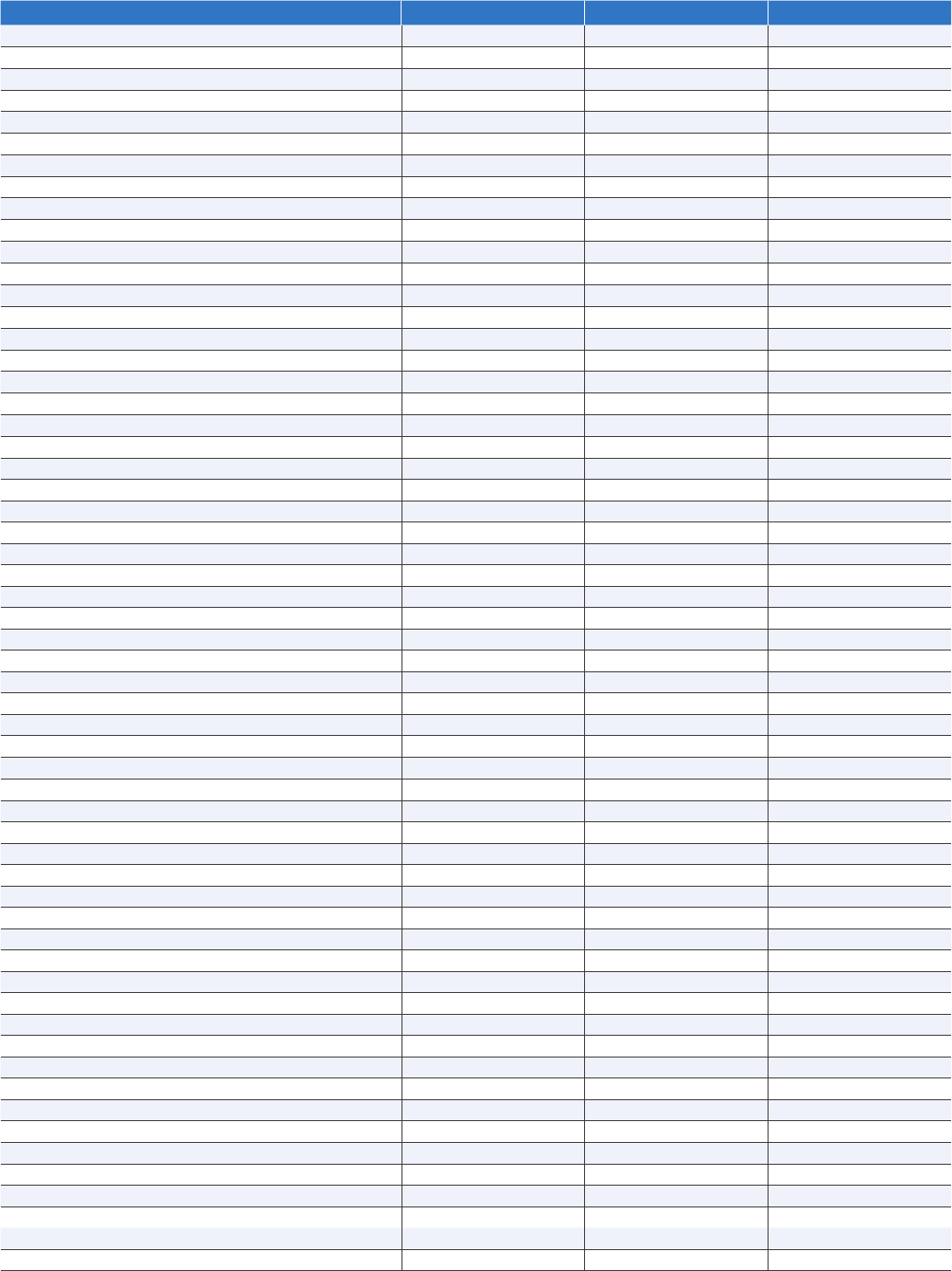

PIMCO Open-End Mutual Funds: PIMCO Funds Qualified Dividend Rate Qualified Short Term Rate Qualified Foreign Rate

PIMCO All Asset All Authority Fund 9.84% – –

PIMCO All Asset Fund 5.86% – –

PIMCO California Intermediate Municipal Bond Fund – – –

PIMCO California Municipal Bond Fund – – –

PIMCO California Short Duration Municipal Income Fund – – –

PIMCO CommoditiesPLUS

®

Strategy Fund – – –

PIMCO CommodityRealReturn Strategy Fund

®

– – –

PIMCO Climate Bond Fund

1

– – –

PIMCO Credit Opportunities Bond Fund – – –

PIMCO Diversified Income Fund – – –

PIMCO Dynamic Bond Fund – – –

PIMCO Emerging Markets Local Currency and Bond Fund – – –

PIMCO Emerging Markets Bond Fund – – –

PIMCO Emerging Markets Corporate Bond Fund – – –

PIMCO Emerging Markets Currency and Short-Term Investments Fund – – –

PIMCO Emerging Markets Full Spectrum Bond Fund – – –

PIMCO Extended Duration Fund – – –

PIMCO Global Advantage

®

Strategy Bond Fund – – –

PIMCO Global Bond Opportunities Fund (U.S. Dollar-Hedged) – – –

PIMCO Global Bond Opportunities Fund (Unhedged) – – –

PIMCO Global Core Asset Allocation Fund

2

18.34% – –

PIMCO GNMA and Government Securities Fund – – –

PIMCO Government Money Market Fund – – –

PIMCO Gurtin California Municipal Intermediate Value Fund* – – –

PIMCO Gurtin California Municipal Opportunistic Value Fund* – – –

PIMCO Gurtin National Municipal Intermediate Value Fund* – – –

PIMCO Gurtin National Municipal Opportunistic Value Fund* – – –

PIMCO High Yield Fund – – –

PIMCO High Yield Municipal Bond Fund – – –

PIMCO High Yield Spectrum Fund – – –

PIMCO Income Fund – – –

PIMCO Inflation Response Multi-Asset Fund – – –

PIMCO International Bond Fund (U.S. Dollar-Hedged) – – –

PIMCO International Bond Fund (Unhedged) – – –

PIMCO Investment Grade Credit Bond Fund 1.09% – –

PIMCO Long Duration Total Return Fund – – –

PIMCO Long-Term Credit Bond Fund – – –

PIMCO Long-Term Real Return Fund – – –

PIMCO Long-Term U.S. Government Fund – – –

PIMCO Low Duration Fund – – –

PIMCO Low Duration Fund II – – –

PIMCO Low Duration ESG Fund – – –

PIMCO Low Duration Income Fund – – –

PIMCO Moderate Duration Fund – – –

PIMCO Mortgage-Backed Securities Fund – – –

PIMCO Mortgage Opportunities and Bond Fund – – –

PIMCO Municipal Bond Fund – – –

PIMCO Multi-Strategy Alternative Fund – – –

PIMCO National Intermediate Municipal Bond Fund – – –

PIMCO New York Municipal Bond Fund – – –

PIMCO Preferred and Capital Securities Fund 61.87% – –

PIMCO RAE Fundamental Advantage PLUS Fund – – –

PIMCO RAE Low Volatility PLUS EMG Fund

^

– – –

PIMCO RAE Low Volatility PLUS Fund

^

– – –

PIMCO RAE Low Volatility PLUS International Fund

^

– – –

PIMCO RAE PLUS EMG Fund – – –

PIMCO RAE PLUS Fund – – –

PIMCO RAE PLUS International Fund – – –

2019 QUALIFIED DIVIDEND INFORMATION | PIMCO SHAREHOLDERS 3

PIMCO Open-End Mutual Funds: PIMCO Funds Qualified Dividend Rate Qualified Short Term Rate Qualified Foreign Rate

PIMCO RAE PLUS Small Fund – – –

PIMCO RAE Worldwide Long/Short PLUS Fund – – –

PIMCO Real Return Fund – – –

PIMCO RealEstateRealReturn Strategy Fund – – –

PIMCO Senior Floating Rate Fund – – –

PIMCO Short Asset Investment Fund – – –

PIMCO Short Duration Municipal Income Fund – – –

PIMCO Short-Term Fund – – –

PIMCO Strategic Bond Fund – – –

PIMCO StocksPLUS

®

Absolute Return Fund – – –

PIMCO StocksPLUS

®

Fund – – –

PIMCO StocksPLUS

®

International Fund (U.S. Dollar-Hedged) – – –

PIMCO StocksPLUS

®

International Fund (Unhedged) – – –

PIMCO StocksPLUS

®

Long Duration Fund – – –

PIMCO StocksPLUS

®

Short Fund – – –

PIMCO StocksPLUS

®

Small Fund – – –

PIMCO Total Return Fund – – –

PIMCO Total Return Fund II – – –

PIMCO Total Return Fund IV – – –

PIMCO Total Return ESG Fund – – –

PIMCO TRENDS Managed Futures Strategy Fund – – –

PIMCO Total Return Fund II 1.18% – –

PIMCO Total Return Fund IV – – –

PIMCO Total Return ESG Fund – – –

PIMCO TRENDS Managed Futures Strategy Fund – – –

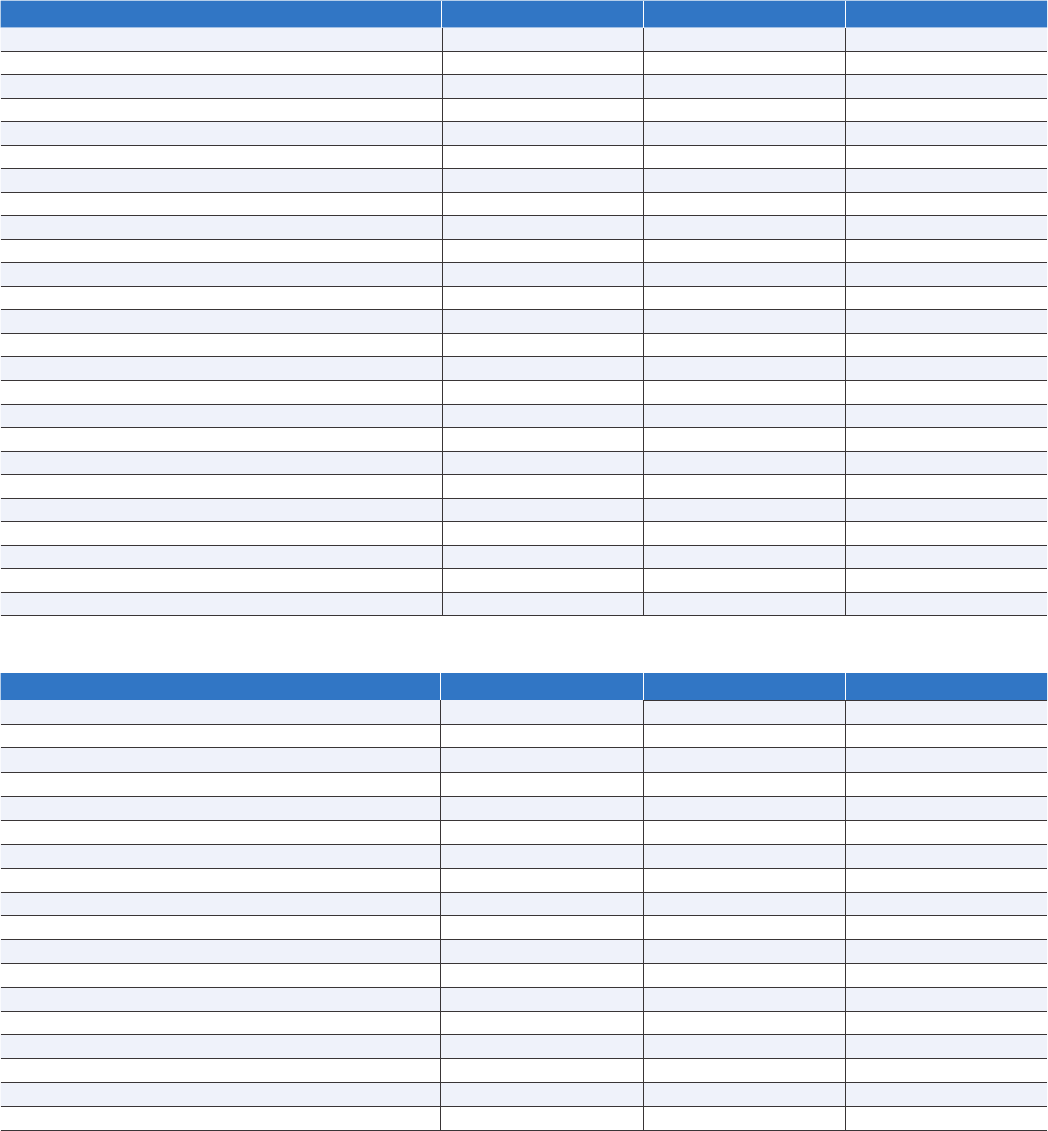

PIMCO Open-End Mutual Funds: PIMCO Equity Series Qualified Dividend Rate Qualified Short Term Rate Qualified Foreign Rate

PIMCO Dividend and Income Fund 93.02% – –

PIMCO EqS

®

Long/Short Fund

3

17.43% – –

PIMCO RAE Emerging Markets Fund 65.50% – 72.14%

PIMCO RAE Global Fund 71.50% – 93.74%

PIMCO RAE Global ex-US Fund 50.45% – 93.71%

PIMCO RAE International Fund 76.16% – 97.01%

PIMCO RAE US Fund 86.34% – –

PIMCO RAE US Small Fund 62.44% – –

PIMCO REALPATH

®

Blend 2020 Fund

4

– – –

PIMCO REALPATH

®

Blend 2025 Fund – – –

PIMCO REALPATH

®

Blend 2030 Fund – – –

PIMCO REALPATH

®

Blend 2035 Fund – – –

PIMCO REALPATH

®

Blend 2040 Fund – – –

PIMCO REALPATH

®

Blend 2045 Fund – – –

PIMCO REALPATH

®

Blend 2050 Fund – – –

PIMCO REALPATH

®

Blend 2055 Fund – – –

PIMCO REALPATH

®

Blend 2060 Fund

6

– – –

PIMCO REALPATH

®

Blend Income Fund – – –

4 2019 QUALIFIED DIVIDEND INFORMATION | PIMCO SHAREHOLDERS

PIMCO Closed-End Funds Qualified Dividend Rate Qualified Short Term Rate Qualified Foreign Rate

PCM Fund, Inc. (PCM) 2.70% – –

PIMCO California Municipal Income Fund (PCQ) – – –

PIMCO California Municipal Income Fund II (PCK) – – –

PIMCO California Municipal Income Fund III (PZC) – – –

PIMCO Corporate & Income Opportunity Fund (PTY) 2.80% – –

PIMCO Corporate & Income Strategy Fund (PCN) 3.42% – –

PIMCO Dynamic Credit and Mortgage Income Fund (PCI) 2.98% – –

PIMCO Dynamic Income Fund (PDI) – – –

PIMCO Energy and Tactical Credit Opportunities Fund (NRGX) 22.54% – –

PIMCO Global StocksPlus & Income Fund (PGP) 3.44% – –

PIMCO High Income Fund (PHK) 4.42% – –

PIMCO Income Opportunity Fund (PKO) 3.07% – –

PIMCO Income Strategy Fund (PFL) 3.14% – –

PIMCO Income Strategy Fund II (PFN) 3.23% – –

PIMCO Municipal Income Fund (PMF) – – –

PIMCO Municipal Income Fund II (PML) – – –

PIMCO Municipal Income Fund III (PMX) – – –

PIMCO New York Municipal Income Fund (PNF) – – –

PIMCO New York Municipal Income Fund II (PNI) – – –

PIMCO New York Municipal Income Fund III (PYN) – – –

PIMCO Strategic Income Fund, Inc. (RCS) 1.50% – –

PIMCO Interval Funds Qualified Dividend Rate Qualified Short Term Rate Qualified Foreign Rate

PIMCO Flexible Credit Income Fund 1.47% – –

PIMCO Flexible Municipal Income Fund

5

3.59% 13.76% –

1

Fund commenced operations on December 10, 2019

2

Effective July 31, 2019, PIMCO Global Multi-Asset Fund changed its name to PIMCO Global Core Asset Allocation Fund

3

On December 6, 2019 PIMCO EqS

®

Long/Short Fund was acquired by PIMCO RAE Worldwide Long/Short PLUS Fund

4

On January 10, 2020 PIMCO REALPATH

®

Blend 2020 Fund was acquired by PIMCO REALPATH

®

Blend Income Fund

5

Fund commenced operations on March 15, 2019

6

Fund commenced operations on December 31, 2019

* Fund was acquired by PIMCO on March 18, 2019

^

Fund is scheduled to liquidate on February 7, 2020

66683-PIMCO

CM R2 019 -1118 - 425192

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information is

contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your financial advisor or PIMCO representative

or by visiting pimco.com. Please read them carefully before you invest or send money.

Closed-end funds, unlike open-end funds, are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange. Closed-

end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. Investment policies, management fees and other matters of interest

to prospective investors may be found in each closed-end fund annual and semi-annual report. For additional information, please contact your investment professional.

It is important to note that differences exist between the fund’s daily internal accounting records, the fund’s financial statements prepared in accordance with U.S. GAAP,

and record keeping practices under income tax regulations. It is possible that the fund may not issue a Section 19 Notice in situations where the fund’s financial statements

prepared later and in accordance with U.S. GAAP or the final tax character of those distributions might later report that the sources of those distributions included capital

gains and/or a return of capital. Please see the fund’s most recent shareholder report for more details.

Although the Funds may seek to maintain stable distributions, the Funds’ distribution rates may be affected by numerous factors, including but not limited to changes in

realized and projected market returns, fluctuations in market interest rates, Fund performance, and other factors. There can be no assurance that a change in market conditions

or other factors will not result in a change in the Funds’ distribution rate or that the rate will be sustainable in the future.

For instance, during periods of low or declining interest rates, the Funds’ distributable income and dividend levels may decline for many reasons. For example, the Fund may

have to deploy uninvested assets (whether from purchases of Fund shares, proceeds from matured, traded or called debt obligations or other sources) in new, lower yielding

instruments. Additionally, payments from certain instruments that may be held by the Fund (such as variable and floating rate securities) may be negatively impacted by

declining interest rates, which may also lead to a decline in the Funds’ distributable income and dividend levels.

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market

Price as of quarter end. Distributions may include ordinary income, net capital gains, and/or return of capital (ROC) of your investment in the fund).

Because the distribution rate may include a ROC, it should not be confused with yield or income. A negative value for Undistributed Net Investment

Income represents the potential for a ROC. The Section 19 Notice, if applicable, contains distribution composition information. Final determination of a distribution’s tax

character will be made on Form 1099 DIV sent each January.

PIMCO does not provide legal or tax advice. Please consult your tax advisor and/or legal counsel for specific tax questions and concerns.

A word about risk: All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit,

inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to

be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions

in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost

when redeemed. Derivatives and commodity-linked derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and

the risk that a position could not be closed when most advantageous. Commodity-linked derivative instruments may involve additional costs and risks such as changes in

commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international

economic, political and regulatory developments. Investing in derivatives could lose more than the amount invested. Equities may decline in value due to both real and

perceived general market, economic and industry conditions. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency

fluctuations, and economic and political risks, which may be enhanced in emerging markets. High yield, lower-rated securities involve greater risk than higher-rated

securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Mortgage- and asset-backed securities

may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness;

while generally supported by some form of government or private guarantee, there is no assurance that private guarantors will meet their obligations. Income from municipal

bonds is exempt from federal income tax and may be subject to state and local taxes and at times the alternative minimum tax.

An investment in an interval fund is not suitable for all investors. Unlike typical closed-end funds an interval fund’s shares are not typically listed on a stock exchange.

Although interval funds provide limited liquidity to investors by offering to repurchase a limited amount of shares on a periodic basis, investors should consider shares of the

Fund to be an illiquid investment. Investments in interval funds are therefore subject to liquidity risk as an investor may not be able to sell the shares at an advantageous time or

price. There is also no secondary market for an interval Fund’s shares and none is expected to develop. There is no guarantee that an investor will be able to tender all or any

of their requested interval fund shares in a periodic repurchase offer.

An interval fund is an unlisted closed-end “interval fund.” Limited liquidity is provided to shareholders only through the fund’s quarterly offers to repurchase between 5%

to 25% of its outstanding shares at net asset value (subject to applicable law and approval of the Board of Trustees, the Fund currently expects to offer to repurchase 5% of

outstanding shares per quarter). There is no secondary market for the fund’s shares and none is expected to develop. Investors should consider shares of the fund to be an

illiquid investment.

The interval fund’s distribution rate may be affected by numerous factors, including changes in realized and projected market returns, fund performance, and other factors.

There can be no assurance that a change in market conditions or other factors will not result in a change in the fund distribution rate at a future time.

For risks associated with a particular Fund, please refer to the Fund’s prospectus.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial

professional to determine the most appropriate investment options for their financial situation. This material has been distributed for informational purposes only. Information

contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other

publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2019,

PIMCO. PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO. © 2019 PIMCO.