2021 PIMCO Tax Information

Dear Shareholder:

This booklet contains tax information to help you le your

2021 tax returns, including important information about

PIMCO open–end mutual funds, closed–end funds and

interval funds (“PIMCO funds”), and detailed schedules

applicable to certain PIMCO funds you may hold.

In the booklet, you’ll nd:

• Tax form summary (p. 2)

• Dividend and Capital Gain Distributions FAQ (p. 2)

• Overview of the cost basis regulation (p. 2)

• Percentage of income derived from U.S. government

o

bligations for certain PIMCO funds (p. 3–5)

• Percentage of dividends paid that qualify for corporate

d

ividends–received deductions (applies to corporate

shareholders only) (p. 3–5)

• Percentage of foreign source income for certain PIMCO

f

u

nds, including the percentage of foreign source income

that constitutes “qualied foreign dividends” (p. 6)

And for certain PIMCO municipal bond funds:

• Percentage of income that was federally taxable (p. 7)

• Percentage of tax–exempt income that is subject to the

f

e

deral alternative minimum tax (AMT) (p. 7)

• Tax–exempt interest income earned state–by–state

(

O

pen–End Mutual Funds p. 8–10 & Closed–End Funds p.

11–12, & Interval Funds p. 13)

Please note that not all forms and schedules apply to all

P

I

MCO funds or fund shareholders. If applicable, the tax

information is separated by PIMCO Open–End Mutual Funds,

PIMCO Closed–End Funds and PIMCO Interval Funds.

Please call us at the applicable number provided if you

h

a

ve questions or need assistance. You can also visit the

Tax Center page of our website, pimco.com/tax. The page

i

n

cludes additional information that may be helpful to you,

such as Qualied Dividend Rates, distribution dates and

10

99 step–by–step guides.

PIMCO Open–End Mutual Funds only. PIMCO has teamed

u

p w

ith TurboTax

®

and H&R Block

®

to help provide fast,

accurate and secure access to your tax data using your PIMCO

Funds Account Access login credentials. To establish login

credentials needed to access TurboTax

®

and H&R Block

®

software, visit PIMCO Account Access:

• Retail investors (A & C shares) – pimco.com/

myaccountaccess

• Institutional investors (institutional shares only) –

pimco.com/institutionalaccountaccess

As PIMCO does not provide legal or tax advice, please

c

onsult a tax professional and/or legal counsel with any

specic tax questions.

Sincerely,

Erik C. Brown

Vice President, Assistant Treasurer

Telephone number Transfer agent

PIMCO Open–End

Mutual Funds:

888.87.PIMCO

(888.877.4626)

DST Asset Manager

Solutions, Inc.

PIMCO Closed–End

Funds:

844.33.PIMCO

(844.337.4626)

American Stock

T

ransfer & Trust

Company, LLC (AST)

PIMCO Interval

Funds:

844.312.2113 DST Asset Manager

Solutions, Inc.

PIMCO Open–End Mutual Funds

PIMCO Closed–End Funds

PIMCO Interval Funds

PIMCO SHAREHOLDERS

2 2021 PIMCO Tax Information | PIMCO Shareholders

Dividend and Capital Gain

Distributions FAQ

Q: What are distributions and why are they paid?

A: Fund distributions are earnings from the fund’s operations.

The law requires that all prots be passed on to the fund’s

investors in order for the fund to qualify for special tax rules

afforded to funds that benet the shareholder.

Q: What is a capital gain distribution?

A: When a fund sells portfolio securities at a prot, the sale

creates a capital gain. Two types of capital gains are

realized by PIMCO funds – short–term and long–term. Net

short–term capital gains are distributed to shareholders

as Form 1099-DIV Box A income dividends and are taxed

at ordinary income tax rates. For 2021, long–term capital

gain distributions are taxed at a maximum effective rate of

23.8% (20% maximum long–term capital gain rate plus 3.8%

Medicare tax).

Q: How is a fund affected if there is no required

distribution?

A: If a distribution is not required, there are no tax

consequences to shareholders or to the fund. If the fund has

not made a taxable distribution, shareholders will not receive

a Form 1099–DIV for that fund.

Q: How is distribution eligibility determined for PIMCO

funds?

A: The timing of a distribution, and the determination of

shareholder eligibility to receive it, is based on the record

date, ex–dividend date, reinvestment date and payable date

which are typically dened as follows:

• Record Date: Purchases through this day are eligible to

receive the distribution. Shares redeemed on this day are not

eligible to receive the distribution.

Tax Form Description

1099–DIV

Reports dividend and capital gain distributions from your PIMCO funds, excluding retirement plan accounts. Tax–exempt income

dividends paid by certain PIMCO municipal funds are reported in Box 11 of your 2021 1099–DIV. Any private activity bond interest, which

may be subject to the alternative minimum tax (AMT), is in Box 12.

1099–B

Reports redemption proceeds, including exchanges out, of any non–money market funds in your non–retirement account. Your cost or other

basis for shares that were sold and fall under the IRS’s cost basis regulations is included on this form in Box 1e. This information is required

to be reported to the IRS by PIMCO. If your shares have been transferred to PIMCO or have been converted, we may not be able to provide this

cost basis information to you. For general information about cost basis and the regulations, see below or visit pimco.com/cost–basis.

1099–R

Reports any distributions (including rollovers, recharacterizations and conversions) taken from a retirement plan, such as an IRA, or any

qualified retirement plan, such as a pension, profit sharing, 401(k) plan or tax–deferred annuity.

• Ex–Dividend Date: The date on which the distribution

amount per share is deducted from the fund’s NAV per

share.

• Reinvestment Date: The date on which the distribution

proceeds will be reinvested, if so elected, in additional

PIMCO fund shares. Shares will settle on the payable date.

• Payable Date: The fund pays shareholders their proportional

amount of any distribution on this date. For PIMCO funds,

the payable date for distributions paid in cash, if so elected,

for mutual funds is normally the same business day as the

ex–dividend date, except for those funds with daily income

distributions. PIMCO fund shares purchased with reinvested

distributions are usually credited on the reinvestment date.

Cost Basis Regulation

A rule went into effect on January 1, 2012, requiring funds

to report cost basis information to shareholders and to the

IRS for “covered shares,” or those shares purchased on or

after January 1, 2012. When ling your tax return, you will

be required to use the cost basis reported in Box 1e of Form

1099–B to calculate and report the gains and losses from

your covered shares to the IRS. Please note that retirement

accounts are excluded from the cost basis requirements.

For more information about the cost basis requirements, we

encourage you to speak with your nancial advisor or a tax

professional. For general information about cost basis and the

regulations, visit

pimco.com/cost–basis.

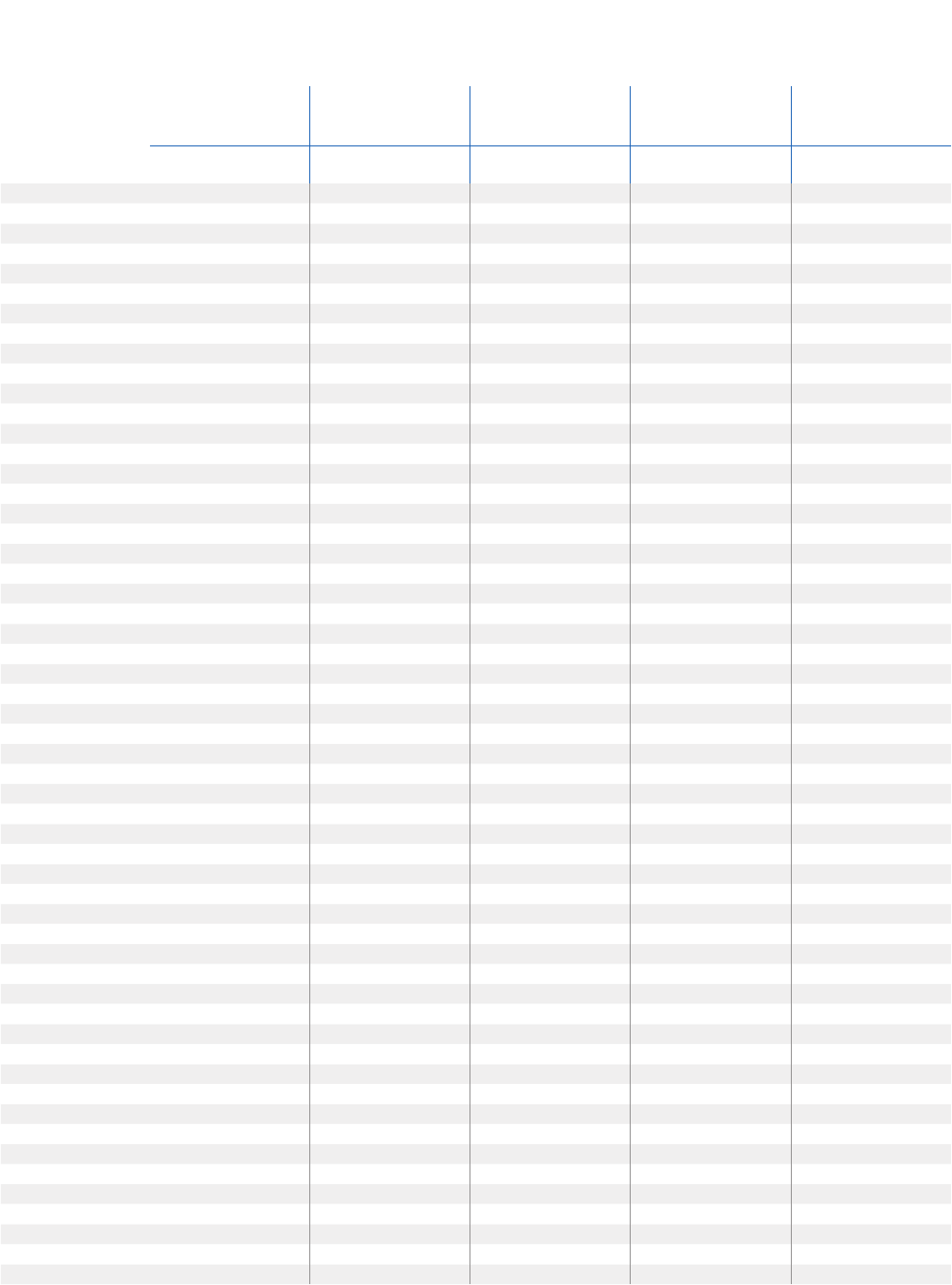

32021 PIMCO Tax Information | PIMCO Shareholders

PIMCO Funds

Percentage of income derived from

U.S. government securities

Corporate dividends

received deduction %

PIMCO All Asset All Authority Fund 11.71% –

PIMCO All Asset Fund 9.51% –

PIMCO California Intermediate Municipal Bond Fund – –

PIMCO California Municipal Bond Fund – –

PIMCO California Municipal Intermediate Value Fund

1

– –

PIMCO California Municipal Opportunistic Value Fund

2

– –

PIMCO California Short Duration Municipal Income Fund – –

PIMCO CommoditiesPLUS

®

Strategy Fund 1.45% –

PIMCO CommodityRealReturn Strategy Fund

®

20.31% –

PIMCO Climate Bond Fund 0.80% –

PIMCO Credit Opportunities Bond Fund 0.73% –

PIMCO Diversied Income Fund 6.03% –

PIMCO Dynamic Bond Fund 12.41% –

PIMCO Emerging Markets Local Currency and Bond Fund 0.19% –

PIMCO Emerging Markets Bond Fund – –

PIMCO Emerging Markets Corporate Bond Fund 2.84% –

PIMCO Emerging Markets Currency and Short–Term Investments Fund 0.05% –

PIMCO Emerging Markets Full Spectrum Bond Fund 0.76% –

PIMCO ESG Income Fund 3.14% –

PIMCO Extended Duration Fund 96.34% –

PIMCO Global Advantage

®

Strategy Bond Fund 24.62% –

PIMCO Global Bond Opportunities Fund (U.S. Dollar–Hedged) 9.27% –

PIMCO Global Bond Opportunities Fund (Unhedged) 14.12% –

PIMCO Global Core Asset Allocation Fund 24.00% 5.00%

PIMCO GNMA and Government Securities Fund 0.04% –

PIMCO Government Money Market Fund 44.98% –

PIMCO High Yield Fund 0.10% –

PIMCO High Yield Municipal Bond Fund – –

PIMCO High Yield Spectrum Fund 0.06% –

PIMCO Income Fund 8.09% –

PIMCO Ination Response Multi–Asset Fund 30.77% –

PIMCO International Bond Fund (U.S. Dollar–Hedged) 8.22% –

PIMCO International Bond Fund (Unhedged) 8.77% –

PIMCO Investment Grade Credit Bond Fund 10.62% 2.25%

PIMCO Long Duration Total Return Fund 30.24% –

PIMCO Long–Term Credit Bond Fund 11.47% –

PIMCO Long–Term Real Return Fund 91.00% –

PIMCO Long–Term U.S. Government Fund 73.43% –

PIMCO Low Duration Fund 0.77% –

2021 Income from U.S.

Government Obligations

Certain PIMCO funds may have earned a portion of their income

from U.S. government securities. All or part of the interest on

these securities may be exempt from state and/or local taxation.

Please consult a tax professional as laws in various jurisdictions

may differ.

The table below reects the percentage of ordinary dividends

derived from U.S. government securities.

For the benet of our corporate shareholders, we have also

included the percentage of dividends that qualify for the

corporate dividends–received deduction, assuming holding

period requirements have been met.

Please use the contact information provided on page one, if

you have questions or need assistance. You can also visit the

Tax Center page of our website, pimco.com/tax.

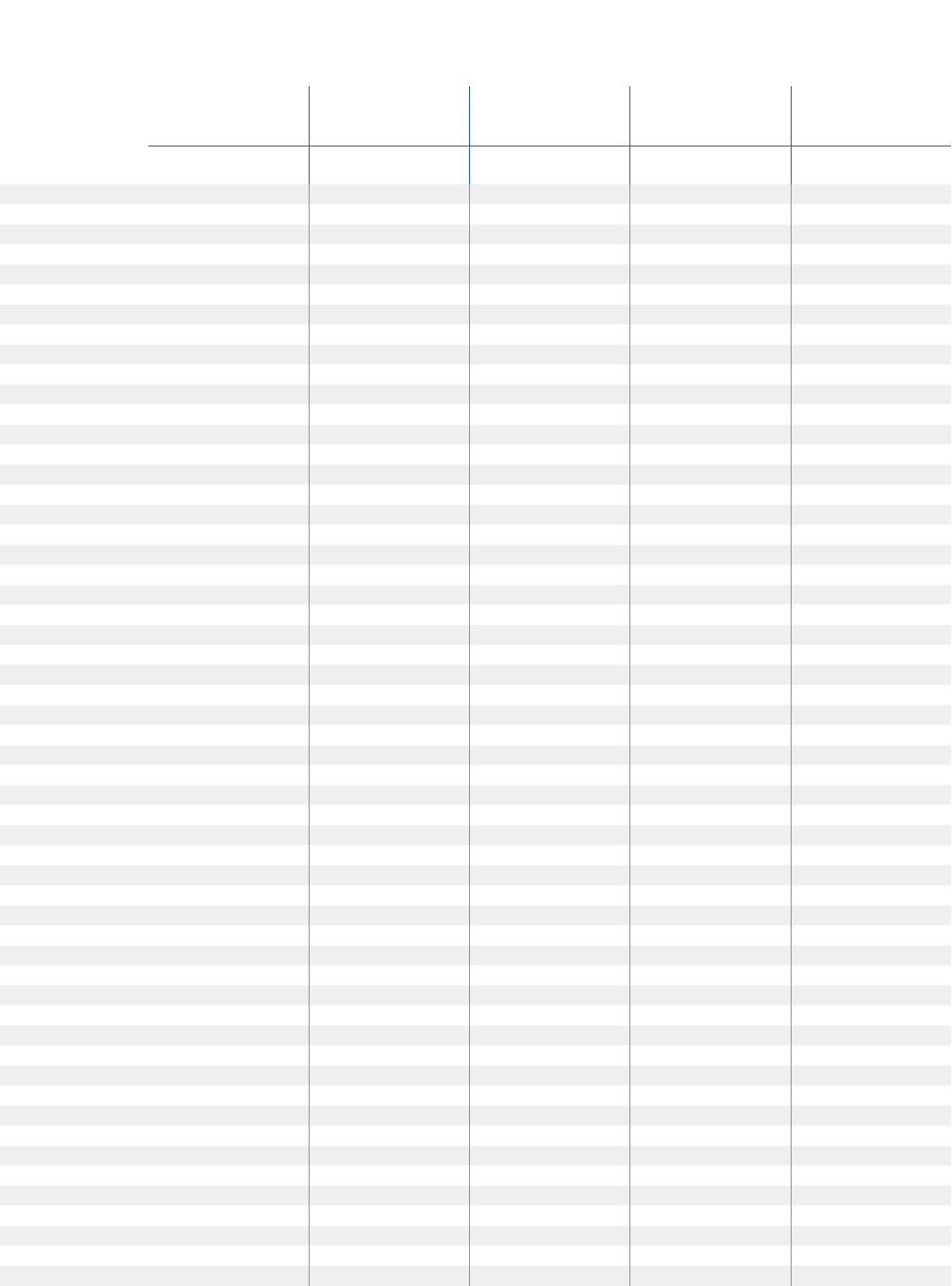

4 2021 PIMCO Tax Information | PIMCO Shareholders

2021 Income from U.S. Government Obligations (continued)

PIMCO Funds

Percentage of income derived from

U.S. government securities

Corporate dividends

received deduction %

PIMCO Low Duration Fund II 3.98% –

PIMCO Low Duration Credit Fund

3

– –

PIMCO Low Duration ESG Fund 1.03% –

PIMCO Low Duration Income Fund 7.35% –

PIMCO Moderate Duration Fund 5.13% –

PIMCO Mortgage–Backed Securities Fund 0.21% –

PIMCO Mortgage Opportunities and Bond Fund 7.04% –

PIMCO Municipal Bond Fund – –

PIMCO Multi–Strategy Alternative Fund

4

2.29% –

PIMCO National Intermediate Municipal Bond Fund – –

PIMCO National Municipal Intermediate Value Fund

5

– –

PIMCO National Municipal Opportunistic Value Fund

6

– –

PIMCO New York Municipal Bond Fund – –

PIMCO Preferred and Capital Securities Fund – 35.33%

PIMCO RAE Fundamental Advantage PLUS Fund – –

PIMCO RAE PLUS EMG Fund 5.71% –

PIMCO RAE PLUS Fund 5.86% –

PIMCO RAE PLUS International Fund 3.36% –

PIMCO RAE PLUS Small Fund 0.88% –

PIMCO RAE Worldwide Long/Short PLUS Fund 4.96% –

PIMCO Real Return Fund 93.15% –

PIMCO RealEstateRealReturn Strategy Fund 16.38% –

PIMCO Short Asset Investment Fund 8.43% –

PIMCO Short Duration Municipal Income Fund – –

PIMCO Short–Term Fund 8.72% –

PIMCO Strategic Bond Fund 11.89% –

PIMCO StocksPLUS

®

Absolute Return Fund 6.99% –

PIMCO StocksPLUS

®

Fund 2.73% –

PIMCO StocksPLUS

®

International Fund (U.S. Dollar–Hedged) 21.10% –

PIMCO StocksPLUS

®

International Fund (Unhedged) 12.28% –

PIMCO StocksPLUS

®

Long Duration Fund 5.20% –

PIMCO StocksPLUS

®

Short Fund – –

PIMCO StocksPLUS

®

Small Fund 10.81% –

PIMCO Total Return Fund 9.84% –

PIMCO Total Return Fund II 13.08% –

PIMCO Total Return Fund IV 12.52% –

PIMCO Total Return ESG Fund 6.08% –

PIMCO TRENDS Managed Futures Strategy Fund 22.12% –

52021 PIMCO Tax Information | PIMCO Shareholders

PIMCO Equity Series

Percentage of income derived from

U.S. government securities

Corporate dividends

received deduction %

PIMCO Dividend and Income Fund 2.36% 34.40%

PIMCO RAE Emerging Markets Fund – –

PIMCO RAE Global Fund – 10.72%

PIMCO RAE Global ex–US Fund – –

PIMCO RAE International Fund – –

PIMCO RAE US Fund – 80.81%

PIMCO RAE US Small Fund – 9.70%

PIMCO REALPATH

®

Blend 2025 Fund 19.53% –

PIMCO REALPATH

®

Blend 2030 Fund 15.98% –

PIMCO REALPATH

®

Blend 2035 Fund 12.18% –

PIMCO REALPATH

®

Blend 2040 Fund 9.50% –

PIMCO REALPATH

®

Blend 2045 Fund 7.31% –

PIMCO REALPATH

®

Blend 2050 Fund 5.97% –

PIMCO REALPATH

®

Blend 2055 Fund 6.15% –

PIMCO REALPATH

®

Blend 2060 Fund 7.35% –

PIMCO REALPATH

®

Blend Income Fund 19.66% –

PIMCO Closed–End Funds

Percentage of income derived from

U.S. government securities

Corporate dividends

received deduction %

PCM Fund, Inc. (PCM) 0.01% –

PIMCO California Municipal Income Fund (PCQ) – –

PIMCO California Municipal Income Fund II (PCK) – –

PIMCO California Municipal Income Fund III (PZC) – –

PIMCO Corporate & Income Opportunity Fund (PTY) 2.15% –

PIMCO Corporate & Income Strategy Fund (PCN) 2.58% –

PIMCO Dynamic Credit and Mortgage Income Fund (PCI)

7

3.15% –

PIMCO Dynamic Income Fund (PDI) 2.54% –

PIMCO Energy and Tactical Credit Opportunities Fund (NRGX) 2.61% –

PIMCO Global StocksPlus & Income Fund (PGP) 0.07% –

PIMCO High Income Fund (PHK) 0.09% –

PIMCO Income Opportunity Fund (PKO)

6

0.48% –

PIMCO Income Strategy Fund (PFL) 1.84% –

PIMCO Income Strategy Fund II (PFN) 1.30% –

PIMCO Municipal Income Fund (PMF) – –

PIMCO Municipal Income Fund II (PML) – –

PIMCO Municipal Income Fund III (PMX) – –

PIMCO New York Municipal Income Fund (PNF) – –

PIMCO New York Municipal Income Fund II (PNI) – –

PIMCO New York Municipal Income Fund III (PYN) – –

PIMCO Strategic Income Fund, Inc. (RCS) 0.02% –

PIMCO Interval Funds

Percentage of income derived from

U.S. government securities

Corporate dividends

received deduction %

PIMCO Flexible Credit Income Fund 0.01% –

PIMCO Flexible Municipal Income Fund 0.08% 3.40%

2021 Income from U.S. Government Obligations (continued)

6 2021 PIMCO Tax Information | PIMCO Shareholders

PIMCO Open–End Mutual Funds: PIMCO Equity Series % of Foreign Source Income % of Qualied Foreign Dividends

RAE Global Fund 45.71% 93.29%

RAE Global ex-US Fund 99.52% 93.21%

RAE Emerging Markets Fund 99.55% 57.84%

RAE International Fund 99.51% 97.00%

2021 Foreign Tax Credit

Information

Below is a summary of the percent of foreign source income

earned and the percent of qualied foreign dividends deemed

paid by PIMCO RAE Global Fund, PIMCO RAE Global ex–US

Fund, PIMCO RAE Emerging Markets Fund, and PIMCO RAE

International Fund. For 2021, these funds represent the funds

for which PIMCO elects to pass through foreign taxes paid to

shareholders. If a fund is not listed below, PIMCO does not elect

to pass through foreign taxes paid to shareholders this year.

Your share of the foreign taxes paid can be used as a tax credit

or a deduction from income on your personal tax return. Please

consult a tax professional to determine whether you qualify for

the foreign tax credit or deduction.

If you choose to claim the foreign tax credit, you may be required

to le Form 1116, Foreign Tax Credit, with your federal income

tax return if your credit exceeds a de minimis threshold. Your

share of “Foreign Taxes Paid” is included in Box 7 of your 2021

Form 1099–DIV. The information below can help you compute

your foreign tax credit.

Please use the contact information provided on page one, if you

have questions or need assistance. You can also visit the Tax

Center page of our website,

pimco.com/tax.

72021 PIMCO Tax Information | PIMCO Shareholders

2021 Municipal Bond Fund

Information

This section contains additional tax–related information for

shareholders of one or more of the below PIMCO municipal

bond and tax–managed funds for 2021.

At least 50% of the value of a fund’s assets must consist of

federally tax–exempt obligations at the close of each quarter

of a fund’s tax year in order for a fund to pass through the tax–

exempt character of its income to shareholders. For all funds

that qualied in 2021, the charts below and on pages 8 through

11 provide (1) the blended percentage of each fund’s dividends

paid in 2021 that was taxable, (2) the percentage of each fund’s

2021 income that was derived from private activity bonds

and subject to the alternative minimum tax (AMT), and (3) the

breakdown of each fund’s tax–exempt interest income by state.

Note that any capital gains distributed by the funds during 2021

are taxable. Short–term capital gains are reported in Box 1a of

Form 1099–DIV as ordinary dividends and long–term capital

gains are reported in Box 2a.

We suggest that you consult a tax professional or call your

state’s tax inquiry center to determine how this information may

apply to your particular tax situation.

Please use the contact information provided on page one, if you

have questions or need assistance. You can also visit the Tax

Center page of our website, pimco.com/tax.

PIMCO Open–End Mutual Funds: PIMCO Funds Taxable income Tax–exempt income

Tax–exempt income

subject to the AMT

PIMCO California Intermediate Municipal Bond Fund 3.19% 96.81% 5.73%

PIMCO California Municipal Bond Fund 6.18% 93.82% 6.94%

PIMCO California Municipal Intermediate Value Fund

1

4.61% 95.39% 5.32%

PIMCO California Municipal Opportunistic Value Fund

2

2.27% 97.73% 19.34%

PIMCO California Short Duration Municipal Income Fund 3.30% 96.70% 0.14%

PIMCO High Yield Municipal Bond Fund 11.84% 88.16% 15.07%

PIMCO Municipal Bond Fund 7.36% 92.64% 6.41%

PIMCO National Intermediate Municipal Bond Fund 9.59% 90.41% 3.08%

PIMCO National Municipal Intermediate Value Fund

5

0.33% 99.67% 1.64%

PIMCO National Municipal Opportunistic Value Fund

6

0.35% 99.65% 15.15%

PIMCO New York Municipal Bond Fund 4.54% 95.46% 4.92%

PIMCO Short Duration Municipal Income Fund 7.64% 92.36% 0.08%

PIMCO Closed–End Funds Taxable income Tax–exempt income

Tax–exempt income

subject to the AMT

PIMCO California Municipal Income Fund (PCQ) 0.59% 99.41% 0.69%

PIMCO California Municipal Income Fund II (PCK) 0.75% 99.25% 0.76%

PIMCO California Municipal Income Fund III (PZC) 0.46% 99.54% 0.69%

PIMCO Municipal Income Fund (PMF) 2.22% 97.78% 1.35%

PIMCO Municipal Income Fund II (PML) 0.68% 99.32% 1.38%

PIMCO Municipal Income Fund III (PMX) 0.77% 99.23% 1.68%

PIMCO New York Municipal Income Fund (PNF) 0.68% 99.32% 0.98%

PIMCO New York Municipal Income Fund II (PNI) 1.05% 98.95% 0.92%

PIMCO New York Municipal Income Fund III (PYN) 0.76% 99.24% 0.84%

PIMCO Interval Funds Taxable income Tax–exempt income

Tax–exempt income

subject to the AMT

PIMCO Flexible Municipal Income Fund 11.75% 88.25% 15.19%

8 2021 PIMCO Tax Information | PIMCO Shareholders

PIMCO Open–End

Mutual Funds:

PIMCO Funds

PIMCO California

I

ntermediate Municipal

Bond Fund

PIMCO California

Municipal Bond Fund

PIMCO California

Municipal Intermediate

Value Fund

1

PIMCO California

Municipal Opportunistic

Value Fund

2

PIMCO California Short

Duration Municipal

Income Fund

% of

Income

% Subject

t

o AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

Alabama – – – – – – – – 0.60% –

Alaska – – – – – – – – – –

Arizona – – 0.51% – – – – – – –

Arkansas – – – – – – – – – –

California 87.51% 4.76% 86.08% 5.67% 86.03% 5.32% 89.16% 18.75% 84.34% 0.14%

Colorado – – – – – – – – – –

Connecticut – – – – – – – – – –

District of Columbia – – – – – – – – – –

Delaware – – – – – – – – – –

Florida 0.57% – 0.64% – – – – – – –

Georgia 0.43% – – – – – – – – –

Guam

0.85% – – – – – – – 1.32% –

Hawaii – – – – – – – – – –

Idaho – – – – – – – – – –

Illinois 3.18% – 3.00% – 13.71% – 8.91% 0.60% 4.84% –

Indiana – – – – – – – – – –

Iowa – – – – – – – – – –

Kansas – – – – – – – – – –

Kentucky 0.72% – – – 0.26% – – – – –

Louisiana – – 0.43% – – – – – 0.41% –

Maine – – – – – – – – – –

Maryland – – – – – – – – – –

Massachusetts – – – – – – – – – –

Michigan 0.11% –

– – – – – – 1.14% –

Minnesota – – – – – – – – – –

Mississippi – – – – – – – – – –

Missouri – – – – – – – – – –

Montana – – – – – – – – – –

Nebraska – – – – – – – – 0.10% –

Nevada – – – – – – – – – –

New Hampshire – – – – – – – – – –

New Jersey 1.32% – 0.85% – – – – – 0.01% –

New Mexico – – – – – – – – – –

New York 1.79% 0.96% 2.95% 1.28% – – – – 2.94% –

North Carolina – – – – – – – – 1.47% –

Northern Mariana Isl – – – – – – – – – –

North Dakota – – – – – – – – – –

Ohio 0.64% – – – – – – – – –

Oklahoma – – – – – – – – – –

Oregon – – – – – – – – 0.39% –

Pennsylvania 0.44% – 0.49% – – – 1.31% – 0.02% –

Puerto Rico 2.39% – 4.49% – – – – – 0.72% –

Rhode Island – – – – – – – – – –

South Carolina – – – – – – – – – –

South Dakota – – – – – – – – – –

Tennessee – – 0.56% – – – – – 0.65% –

Texas – – – – – – – – 0.12% –

Utah – – – – – –

0.62% – – –

Virgin Islands – – – – – – – – – –

Vermont – – – – – – – – – –

Virginia – – – – – – – – – –

Washington 0.05% – – – – – – – – –

West Virginia – – – – – – – – 0.93% –

Wisconsin – – – – – – – – – –

Wyoming – – – – – – – – – –

PIMCO Municipal Bond Funds 2021 Tax Reporting Information – State and Territory Detail

92021 PIMCO Tax Information | PIMCO Shareholders

PIMCO Open–End

Mutual Funds:

PIMCO Funds

PIMCO High Yield

Municipal Bond Fund

PIMCO Municipal

Bond Fund

PIMCO National

Intermediate Municipal

Bond Fund

PIMCO National

Municipal Intermediate

Value Fund

5

PIMCO National

Municipal Opportunistic

Value Fund

6

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

Alabama 2.43% 0.11% 2.17% – 2.38% – 2.68% – 0.47% –

Alaska 0.01% – 0.32% – 0.35% – – – – –

Arizona 2.38% 0.04% 2.56% 0.18% 1.25% – 0.12% – – –

Arkansas 0.39% 0.39% – – – – 0.37% – – –

California 7.95% 0.48% 8.72% 0.68% 2.17% 0.05% 4.28% – 6.35% –

Colorado 1.49% – 3.17% 0.09% 1.98% – – – 2.49% –

Connecticut 0.28% – 2.21% – 8.14% – 10.52% – 12.65% –

District of Columbia 0.05% – 0.80% 0.16% 0.37% – – – 2.17% 2.17%

Delaware 0.12% – 0.15% – – – – – – –

Florida 5.30% 2.84% 3.05% – 3.73% – 2.65% – 3.79% 3.29%

Georgia 2.50% – 5.22% 0.01% 5.66% 1.56% – – – –

Guam 0.07%

– – – 0.76% – – – – –

Hawaii – – – – – – – – 2.58% –

Idaho – – 0.03% – – – – – – –

Illinois 12.44% 0.16% 14.45% 0.71% 11.33% – 16.45% – 22.57% 0.78%

Indiana 2.44% 2.06% 1.29% 0.80% 1.35% – – – 1.47% –

Iowa 0.51% – 0.30% – – – 1.62% – – –

Kansas 0.22% – 0.04% – 0.39% – – – – –

Kentucky 0.90% 0.05% 0.66% 0.01% 1.77% – 7.68% – – –

Louisiana 1.05% – 0.72% – 1.31% – 10.89% – 2.81% 1.11%

Maine 0.38% – 0.31% – 0.23% – – – – –

Maryland 0.51% – 1.24% 0.30% 0.82% – 0.05% – 0.47% –

Massachusetts 0.17% – 1.17% 0.05% 1.91% – 0.02% – 1.62% –

Michigan 2.98% – 1.60% 0.19% 2.73% – 5.99% – 0.65% –

Minnesota 0.37% 0.03% 0.44% – – – 0.47% – – –

Mississippi – – – – 0.58% – – – – –

Missouri 0.49% 0.23% 0.66% 0.34% 0.86% 0.58% 1.41% – – –

Montana 0.09% – – – – – – – – –

Nebraska 0.26% – 0.77% – 0.27% – – – – –

Nevada 0.88% 0.44% 0.73% – – – 1.00% – 1.11% –

New Hampshire 0.33% – 0.55% – 0.08% – – – – –

New Jersey 3.74% 0.33% 4.53% 0.05% 5.50% 0.60% – – – –

New Mexico 0.07% – 0.50% – 1.56% – – – – –

New York 11.08% 2.60% 13.21% 1.06% 9.97% – 1.51% – 5.82% 2.26%

North Carolina – – 0.38% – 2.21% – – – 2.06% –

Northern Mariana Isl – – – – –

– – – – –

North Dakota 0.30% 0.30% – – – – – – – –

Ohio 5.58% 0.95% 3.43% 0.16% 5.49% – 2.93% – 7.74% –

Oklahoma 0.47% 0.03% 0.24% 0.04% – – – – – –

Oregon 0.64% 0.03% 1.14% – 0.86% – – – – –

Pennsylvania 3.86% 1.57% 3.30% 0.31% 5.95% – 12.89% – 13.70% –

Puerto Rico 9.10% – 4.43% – 2.56% – – – – –

Rhode Island 0.32% – – – – – 0.75% – – –

South Carolina 1.07% – 0.59% – – – 0.81% 0.81% – –

South Dakota – – – – 0.43% – 0.75% – – –

Tennessee 0.95% – 1.13% – 2.08% – – – – –

Texas 5.87% 1.97% 6.64% 0.45% 8.73% – 11.47% 0.45% 3.31% 1.18%

Utah 0.18% – 0.83% 0.40% 0.38% – – – 0.18% –

Virgin Islands – – – – – – – – – –

Vermont – – – – – – 0.08% – – –

Virginia 0.91% 0.34% 1.12% 0.55% 0.29% 0.29% – – 1.98% 1.98%

Washington 1.24% – 2.05% – 1.37% – 0.42% 0.38% 4.01% 2.38%

West Virginia 2.01% 0.03% 0.14% – 0.80% – 0.32% – – –

Wisconsin 5.62% 0.08% 3.01% 0.14% 1.40% – 1.87% – – –

Wyoming – – – – – – – – – –

PIMCO Municipal Bond Funds 2021 Tax Reporting Information – State and Territory Detail (continued)

10 2021 PIMCO Tax Information | PIMCO Shareholders

PIMCO Open–End

Mutual Funds:

PIMCO Funds

PIMCO New York

Municipal Bond Fund

PIMCO Short Duration

Municipal Income Fund

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

Alabama 0.33% – 0.73% –

Alaska – – – –

Arizona 0.65% – 1.41% –

Arkansas – – – –

California 0.14% 0.14% 3.22% 0.09%

Colorado – – 1.15% –

Connecticut – – 7.96% –

District of Columbia – – 0.41% –

Delaware – – 1.02% –

Florida 0.24% – 5.16% –

Georgia 0.31% – 2.86% –

Guam – – – –

Hawaii – – – –

Idaho – – 0.01% –

Illinois 5.26% – 13.51% –

Indiana – – 1.14% –

Iowa – – 0.11% –

Kansas – – 0.71% –

Kentucky 0.57% – 2.04% –

Louisiana 0.69% – 1.47% –

Maine – – – –

Maryland – – 0.68% –

Massachusetts – – 3.92% –

Michigan 0.06% – 4.17% –

Minnesota – – 0.08% –

Mississippi – – 1.21% –

Missouri – – 0.80% –

Montana – – 0.08% –

Nebraska – – 0.75% –

Nevada – – 0.82% –

New Hampshire – – – –

New Jersey 1.26% – 4.67% –

New Mexico – – 2.23% –

New York 84.54% 4.78% 12.01% –

North Carolina – – 0.38% –

Northern Mariana Isl – – – –

North Dakota – – – –

Ohio – – 1.50% –

Oklahoma – – – –

Oregon – – 0.22% –

Pennsylvania 0.39% – 5.61% –

Puerto Rico 5.01% – 0.75% –

Rhode Island – – – –

South Carolina – – 1.86% –

South Dakota – – 0.06% –

Tennessee 0.51% – 0.19% –

Texas 0.04% – 9.79% –

Utah – – 0.78% –

Virgin Islands – – – –

Vermont – – – –

Virginia – – 0.40% –

Washington – – 1.59% –

West Virginia – – 1.82% –

Wisconsin – – 0.72% –

Wyoming – – – –

PIMCO Municipal Bond Funds 2021 Tax Reporting Information – State and Territory Detail (continued)

112021 PIMCO Tax Information | PIMCO Shareholders

PIMCO Closed–

End Funds

PIMCO California

Municipal I

ncome

Fund (PCQ)

PIMCO California

Municipal Income

Fund II (PCK)

PIMCO California

Municipal Income

Fund III (PZC)

PIMCO Municipal

Income Fund (PMF)

PIMCO Municipal

Income Fund II (PML)

% of

Income

% Subject

t

o AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

Alabama – – – – – – 5.70% – 5.87% –

Alaska – – – – – – – – – –

Arizona 0.39% – 0.43% – 0.39% – 2.19% – 5.77% –

Arkansas – – – – – – 0.58% – – –

California 88.66% – 87.37% – 89.30% – 5.65% – 3.40% –

Colorado – – – – – – 2.71% – 1.43% –

Connecticut – – – – – – 1.38% – 0.52% –

District of Columbia – – – – – – 0.18% – 0.23% –

Delaware – – – – – – – – – –

Florida – – – – – – 2.01% 0.15% 2.31% 0.28%

Georgia – – – – – – 3.16%

– 3.46% –

Guam – – – – – – – – – –

Hawaii – – – – – – 0.24% – – –

Idaho – – – – – – – – – –

Illinois 4.19% – 5.12% – 4.40% – 9.29% – 10.80% –

Indiana – – – – – – 0.60% 0.30% 0.40% 0.93%

Iowa – – – – – – 0.08% – 0.53% –

Kansas – – – – – – 0.52% – 0.38% –

Kentucky – – – – – – – – – –

Louisiana 0.09% – 0.10% – 0.04% – 2.42% – 1.90% –

Maine – – – – – – 0.27% – 0.29% –

Maryland – – – – – – 0.09% – 1.02% –

Massachusetts – – – – – – 1.87% – 2.37%

–

Michigan 0.35% – 0.38% – 0.35% – 2.36% – 2.37% –

Minnesota – – – – – – 0.26% – 0.30% –

Mississippi – – – – – – – – – –

Missouri – – – – – – 0.65% – 1.08% –

Montana – – – – – – – – – –

Nebraska – – – – – – 0.49% – – –

Nevada – – – – – – 0.89% – 0.91% –

New Hampshire – – – – – – – – – –

New Jersey 0.25% – 0.04% – 0.27% – 9.36% – 5.27% –

New Mexico – – – – – – – – – –

New York 0.36% – 0.82% – 0.36% – 14.01% – 13.27% –

North Carolina – – – – – – – – 0.21% –

Northern Mariana Isl

– – – – – – – – – –

North Dakota 0.15% 0.15% 0.16% 0.43% 0.15% 0.07% 0.14% 0.14% 0.46% 0.51%

Ohio 0.60% – 0.70% – 0.66% – 3.83% 0.21% 5.92% 0.89%

Oklahoma – – – – – – 0.21% – 0.34% –

Oregon – – – – – – 0.06% – 0.09% –

Pennsylvania 0.57% 0.44% 0.89% 1.23% 0.43% 0.21% 4.71% 0.41% 5.02% 1.47%

Puerto Rico 3.67% – 3.21% – 2.93% – 2.72% – 2.70% –

Rhode Island – – – – – – 0.44% – 2.54% –

South Carolina – – – – – – 1.39% – 1.04% –

South Dakota – – – – – – – – – –

Tennessee – – – – – – 3.05% – 1.40% –

Texas 0.11% 0.11% 0.12% 0.30% 0.10% 0.05% 7.96% 0.11% 9.77% 0.61%

Utah – –

– – – – 2.30% – 0.28% –

Virgin Islands – – – – – – – – – –

Vermont – – – – – – – – – –

Virginia 0.12% – 0.13% – 0.13% – 1.41% – 1.97% –

Washington – – – – – – 0.33% – 0.36% –

West Virginia – – – – – – 0.44% – 0.46% –

Wisconsin 0.49% – 0.53% – 0.49% – 4.05% 0.02% 3.56% 0.09%

Wyoming – – – – – – – – – –

PIMCO Closed–End Municipal Bond Funds 2021 Tax Reporting Information – State and Territory Detail

12 2021 PIMCO Tax Information | PIMCO Shareholders

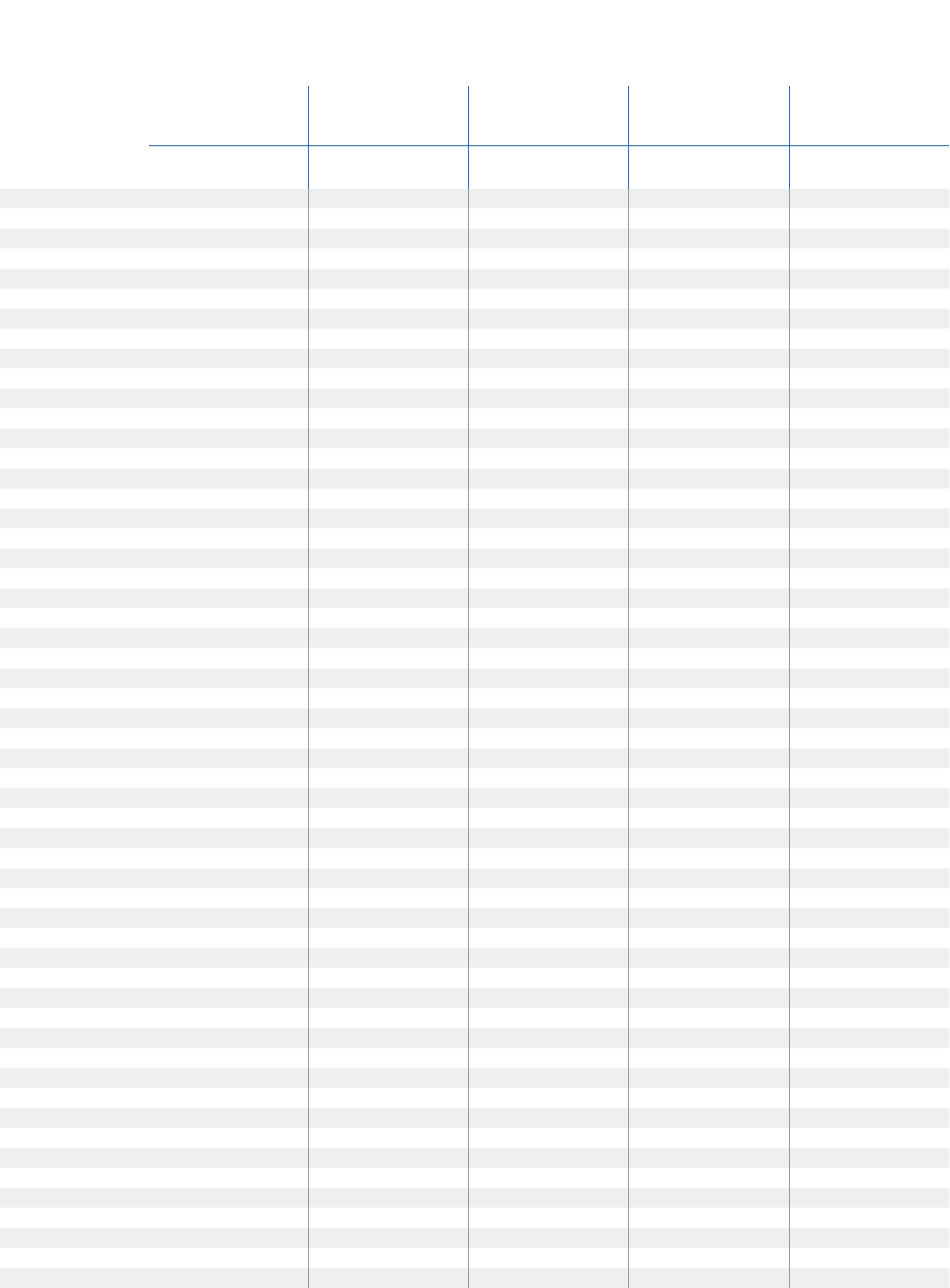

PIMCO Closed–

End Funds

PIMCO Municipal Income

Fund III (PMX)

PIMCO New York

Municipal Income

Fund (PNF)

PIMCO New York

Municipal Income

Fund II (PNI)

PIMCO New York

Municipal Income

Fund III (PYN)

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

% of

Income

% Subject

to AMT

Alabama 7.50% – – – – – – –

Alaska – – – – – – – –

Arizona 4.50% – 0.45% – 0.43% – 0.36% –

Arkansas – – – – – – – –

California 5.87% – 1.01% – – – – –

Colorado 1.42% – – – – – – –

Connecticut 0.66% – – – – – – –

District of Columbia 0.37% – – – – – – –

Delaware – – – – – – – –

Florida 6.14% 2.44% – – – – – –

Georgia 3.29% – – – – – – –

Guam – – – – – – – –

Hawaii – – – – – – – –

Idaho – – – – – – – –

Illinois 10.60% – 3.59% – 3.89% – 4.39% –

Indiana 0.87% 2.07% – – – – – –

Iowa 0.07% – – – – – – –

Kansas 0.29% – – – – – – –

Kentucky – – – – – – – –

Louisiana 2.37% – 0.11% – 0.10% – 0.10% –

Maine 0.32% – – – – – – –

Maryland 0.70% – – – – – – –

Massachusetts 3.74% – – – – – – –

Michigan 2.25% – 0.39% – 0.39% – 0.35% –

Minnesota 0.29% – – – – – – –

Mississippi – – – – – – – –

Missouri 0.09% – – – – – – –

Montana – – – – – – – –

Nebraska 1.06% – – – – – – –

Nevada 0.90% – – – – – – –

New Hampshire – – – – – – – –

New Jersey 5.95% – 0.28% – 0.27% – 0.26% –

New Mexico – – – – – – – –

New York 8.09% – 88.11% 0.18% 89.14% 0.92% 88.67% 0.07%

North Carolina 1.39% – – – – – – –

Northern Mariana Isl – – – – – – – –

North Dakota 0.15% 1.10% 0.17% 0.17% 0.17% 1.02% 0.15% 0.07%

Ohio 5.36% 2.10% 0.73% – 0.72% – 0.64% –

Oklahoma 0.46% – – – – – – –

Oregon 0.06% – – – – – – –

Pennsylvania 4.63% 3.15% 0.80% 0.51% 0.48% 2.92% 1.03% 0.21%

Puerto Rico 2.72% – 3.46% – 3.58% – 3.22% –

Rhode Island – – – – – – – –

South Carolina 1.45% – – – – – – –

South Dakota – – – – – – – –

Tennessee 0.46% – – – – – – –

Texas 7.60% 1.30% 0.12% 0.12% 0.12% 0.71% 0.11% 0.05%

Utah 0.48% – – – – – – –

Virgin Islands – – – – – – – –

Vermont – – – – – – – –

Virginia 2.11% – 0.23% – 0.18% – 0.21% –

Washington 1.18% – – – – – – –

West Virginia 0.52% – – – – – – –

Wisconsin 4.09% 0.19% 0.55% – 0.53% – 0.51% –

Wyoming – – – – – – – –

PIMCO Closed–End Municipal Bond Funds 2021 Tax Reporting Information – State and Territory Detail (continued)

132021 PIMCO Tax Information | PIMCO Shareholders

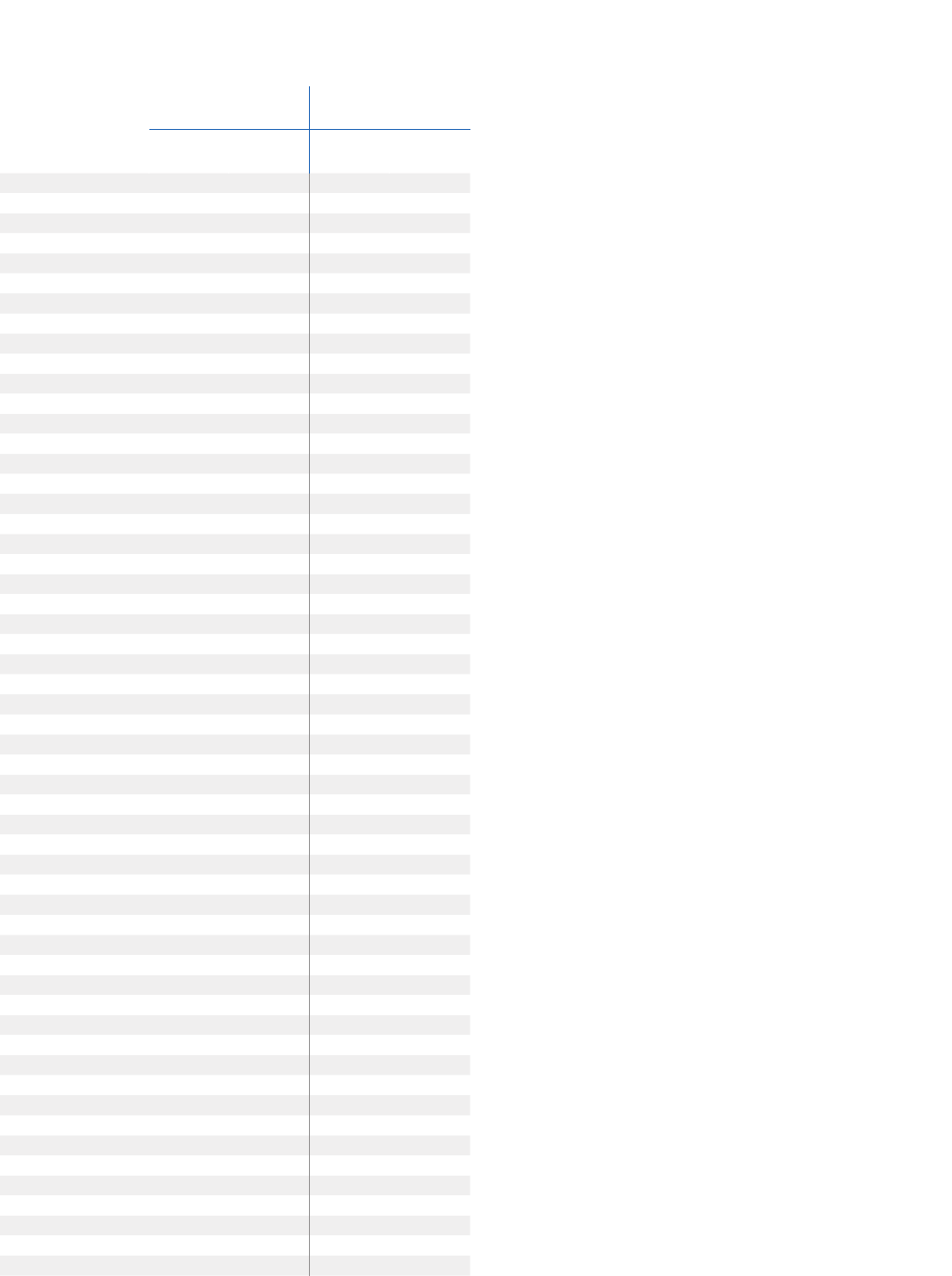

PIMCO Interval Funds

PIMCO Flexible

Municipal Income Fund

% of

Income

% Subject

to AMT

Alabama 2.25% 0.20%

Alaska 0.27% –

Arizona 3.48% –

Arkansas 0.38% 0.38%

California 8.58% 1.13%

Colorado 1.83% –

Connecticut 1.47% –

District of Columbia – –

Delaware 0.19% –

Florida 4.44% 2.42%

Georgia 1.93% 0.44%

Guam 0.34% –

Hawaii – –

Idaho 0.07% –

Illinois 10.65% –

Indiana 1.95% 1.68%

Iowa 0.84% 0.07%

Kansas 0.18% –

Kentucky 1.23% –

Louisiana 1.35% –

Maine 0.11% –

Maryland 1.00% –

Massachusetts 0.31% –

Michigan 1.96% 0.02%

Minnesota 0.17% –

Mississippi 0.02% –

Missouri 0.96% 0.10%

Montana – –

Nebraska – –

Nevada 0.02% 0.02%

New Hampshire 0.63% 0.08%

New Jersey 3.73% 0.95%

New Mexico – –

New York 11.65% 2.15%

North Carolina 1.49% –

Northern Mariana Isl – –

North Dakota 0.31% 0.31%

Ohio 5.24% 0.84%

Oklahoma 0.23% 0.11%

Oregon 0.77% 0.06%

Pennsylvania 3.95% 1.75%

Puerto Rico 8.05% –

Rhode Island 0.31% –

South Carolina 1.14% 0.05%

South Dakota – –

Tennessee 1.32% –

Texas 5.52% 1.96%

Utah 0.32% –

Virgin Islands – –

Vermont – –

Virginia 0.96% 0.34%

Washington 1.24% –

West Virginia 1.37% 0.06%

Wisconsin 5.79% 0.07%

Wyoming – –

PIMCO Interval Municipal Bond Funds 2021 Tax Reporting Information – State and Territory Detail

PTAX_72483

CMR2022-0121-2002510

pimco.com

blog.pimco.com

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information

are contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your investment professional or

PIMCO representative or by visiting

www.pimco.com.

It is important to note that differences exist between the fund’s daily internal accounting records, the fund’s financial statements prepared in accordance with

U.S. GAAP, and record keeping practices under income tax regulations. It is possible that the fund may not issue a Section 19 Notice in situations where the fund’s

financial statements prepared later and in accordance with U.S. GAAP or the final tax character of those distributions might later report that the sources of those

distributions included capital gains and/or a return of capital. Please see the fund’s most recent shareholder report for more details.

PIMCO does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns. The discussion herein is

gene

ral in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Any tax statements contained herein

are not intended or written to be used, and cannot be relied upon or used for the purpose of avoiding penalties imposed by the Internal Revenue Service or state and

local tax authorities. Individuals should consult their own legal and tax counsel as to matters discussed herein.

The actual amounts and composition of distributions for tax reporting purposes will depend upon the Fund’s investment experience during its entire fiscal year and

may be

subject to changes based on tax regulations. Final determination of a distribution’s tax character will be reported on Form 1099 DIV sent to shareholders

for the calendar year.

For risks associated with a particular Fund, please refer to the Fund’s prospectus.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their

o

wn fi

nancial professional to determine the most appropriate investment options for their financial situation. This material has been distributed for informational

purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. No part of

this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset

Management of America L.P. in the United States and throughout the world. PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company

of PIMCO. ©2022 PIMCO.

1 Name changed from PIMCO Gurtin California Municipal Intermediate Value Fund to PIMCO California Municipal Intermediate Value Fund on March 1, 2021

2

Name changed from PIMCO Gurtin California Municipal Opportunistic Value Fund to PIMCO California Municipal Opportunistic Value Fund on March 1, 2021

3

Name changed from PIMCO Senior Floating Rate Fund to PIMCO Low Duration Credit Fund on May 3, 2021

4

On May 14, 2021 PIMCO Multi-Strategy Alternative Fund was liquidated

5

Name changed from PIMCO Gurtin National Municipal Intermediate Value Fund to PIMCO National Municipal Intermediate Value Fund on March 1, 2021

6

Name changed from PIMCO Gurtin National Municipal Opportunistic Value Fund to PIMCO National Municipal Opportunistic Value Fund on March 1, 2021

7

On December 10, 2021 PIMCO Dynamic Credit and Mortgage Income Fund and PIMCO Income Opportunity Fund were acquired by PIMCO Dynamic Income Fund